MITIGATE RISKS OF FOSSIL FUELLS

The Tanzania Power System Master Plan (PSMP 2020) plans an energy mix for 2044 with still 60 % coming from high greenhouse gas-emitting fossil fuels such as coal and fossil gas. Fossil gas specific natural gas is often framed as a necessary bridging technology that must be upscaled in developing countries to secure development. Contrary to this, the dependence on such technology is like a quicksand pit that slowly hinders national development. Fossil fuel impact all Social Development Goals (SDGs) ne-gatively and threaten the realization of SDGs significant.(Ref: Fuelling Failure Report 2022). Fossil fuels are a dange-rous distraction from the necessary energy transition in developing countries.

Reviewing arguments

of the PSMP 2020

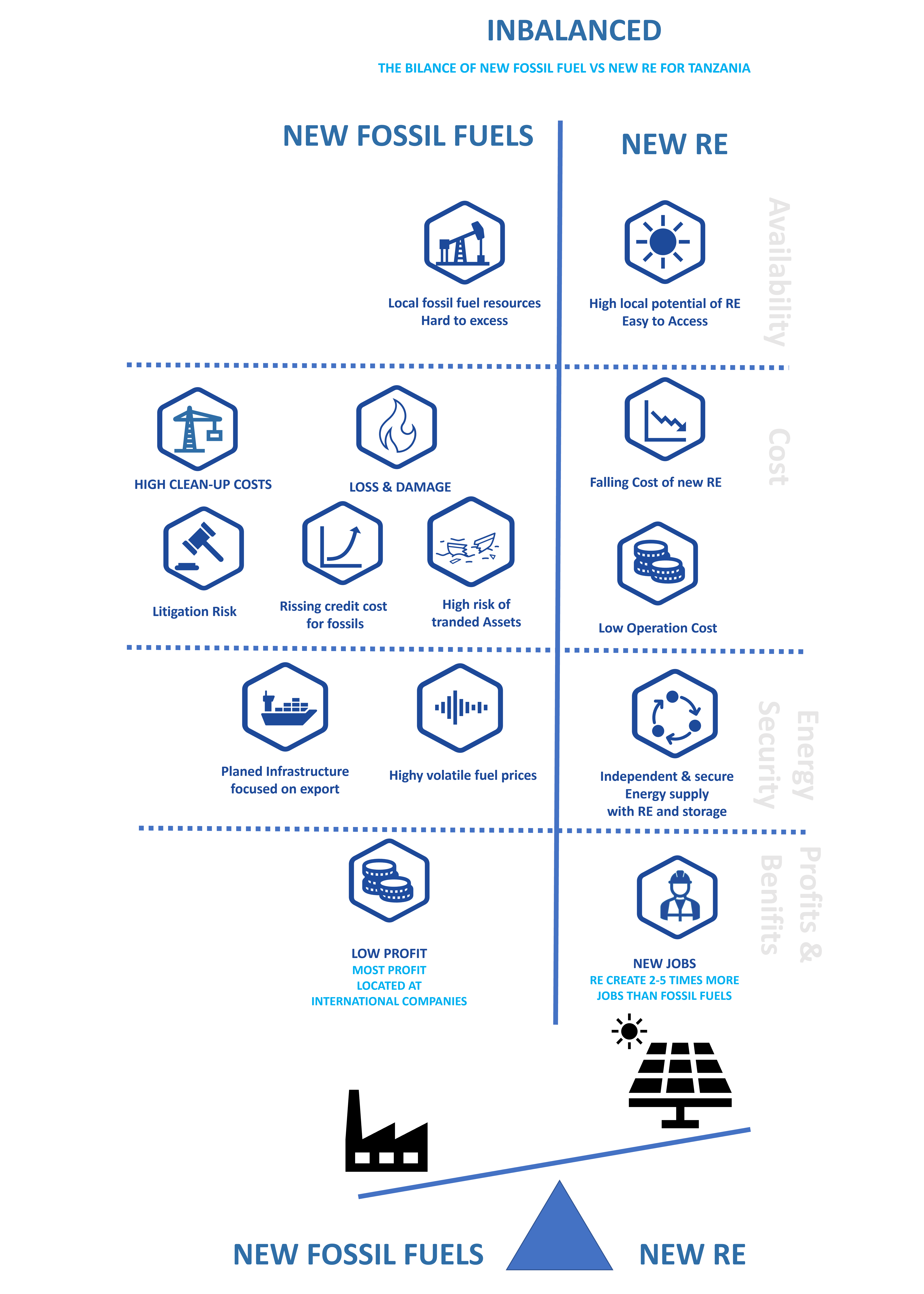

The arguments favouring fossil-based pathway that increases the role of coal and natural gas as por-trayed in the PSMP 2020 and Tanza-nia Development plans are; (1) coal and natural gas are locally found in significant quantities and can be ex-tracted at feasible costs (2) they can be used to produce electricity at an affordable cost (3) its energy genera-tion capacity can be controlled to match demand (4) locally sourced hence not susceptible to international impacts (5) it’s a big industry that offer multiple job opportunities, (7) other useful by-products are provided along with energy and lastly (6) devel-opment of technology for land recla-mation and energy production enable reduction of carbon footprint (impact) of fossil fuels.

Questioning Arguments for Fossils

The argument for fossil-based path-way has to be critical reviewed. In specific the main argument of afford-able cost is challenged by recent sce-nario studies, that explore cost-effective pathways.

The use of fossil based fuel is like a quick sand entrapping victims slow with future difficulties to escape. The counter arguments promoting RE pathway as portrayed in CETT are as follows;

Falling cost of RE

The falling cost for installation and operation of new RE plants and rising cost of installation and operation of new fossil fuel-based power plants makes it more cost effective. Cost of RE is falling drastically due to high demand, on-going innovation, low maintenance and operation cost (IRENA 2020, REN21, p.30). Worldwide renewable energies are the cheapest source for power generation. (IRENA2019, IEA 2020, LAZARD 2020)

Energy security with RE vs

Energy dependency with fossil fuels

RE are independent from highly volatile imported fossil fuel prices such as heavy fuel oil used in standby national generators, therefore RE guarantee low cost and easy ac-cess. The Ukraine-war showcase how vulnerable econo-mies depend on fossil fuels are and how fossil fuel depend-ency impacts the economy and energy security. Most ex-isting and planed fossil infrastructure in Tanzania is focused on export on gas and oil and while therefore not enhance access to energy.

The CETT scenario show that with sufficient installed ca-pacity of RE (54.8 GW) combined with storage technology ( 8.5 GW) a secure and independent supply of Tanzania with 100 % RE is possible by 2050 and cheaper then a fossil-based pathway.( Clean Energy Transition Tanzania 2022)

Rising cost of fossil fuel investments

Additional project cost of new fossil fuel projects are con-stantly rising because banks, fund, investors, and insur-ance companies increasingly divest from fossil fuels and exclude them from there portfolio. Fossil fuel project be-came substantial unbearable risk for the portfolio of inves-tors and insurance companies. Due to this the cost for credits and funding for new fossil fuel projects skyrock-eting because investors want to avoid potential stranded assets and insurance companies are not longer willing to take the risk to insure fossil projects. (Banking on Climate Chaos 2022)

Local Availability: Easy Access to RE, Hard Access to Fossil Fuels

Over half of the planned gas extraction projects in Tanzania would come from “ultra deepwater drilling” (Rystad Energy UCube January 2021) This is a extremely costly and risk process to extract gas. High operation and extraction cost make it less competitive on the global market. In a world which limit its carbon budget to stay below 1.5°C only few cheapest fossil fuel project will be able to supply the low demand which will be within the carbon budget. Produc-tion with high cost will end up as stranded assets. ( The Skys Limit Africa Report 2021). The IEA warned offshore gas production in Tanzania and Mozambique was at risk of “cost overruns which could significantly undermine the competitiveness of the projects (IEA, Africa Energy Outlook 2019). While the lack of gas infrastructure makes building new gas power generation facility costly and difficult to plan in contrast new renewable energies can be developed off-grid with a minimum need of supporting infrastrutucre. In comparison to gas a remarkable benefit of renewable energy is its well position to enhance energy access for rural areas with off-grid solutions (IRENA 2019).

Lock-In into future cost an burden of clean-up costs

Fossil extraction sectors also burdens the local society and future generation with massive challenges of decommis-sioning, clean-up and close-down cost especially for coal mining that cover hundreds of hectares and excavates the land. The condition and cost of fair decommissioning and close-down are often not clearly and fairly shared. Often African countries are left alone with it while interna-tional cooperation benefit from most of the generated profits.

WHO PAYS THE PRICE: LOSS & DAMAGE

Externalized cost: Loss and damage

Loss and damage caused by climate change is increasing. The recent IPCC Impact report (IPCC 2022) show extreme cli-mate event have been observed causing impacts on health, livelihood and well-being for impacted societies. The cli-mate crisis is mainly caused by emissions from fossil fuels. A pathway for the energy sector relying heavily on fossil fuels have to factor in that this burden unproportionally high cost of loss and damage on its own society. The impacts caused by THG emission are not yet reflected in cost-scenarios of the energy system. A tonne CO2e emitted in 2050 is estimat-ed to cause loss and damage of 417 USD. globally and up to 4.19 USD in Tanzania alone.

The CETT scenario will have 0 CO2-emission in 2050 per year while the implementation of the PSMP will contribute to climate crisis with 56 mt CO2e.Therefore the implementation of the PSMP2020 would cause due to its emission in 2050 annual loss and damage of 23.3 bn USD globally, up to 240 bn USD in Tanzania and 12656 excess deaths per year

Risk of stranded assets and litigation

Increasing climate impacts and experienced loss and dam-ages coupled with evolution of legal mechanisms and attribution science of accountability is catalysing climate change litigation worldwide. Climate litigation doubled since 2015 (Setzer & Higham 2021).Investors fear the fi-nancial and reputational risk of litigation based on fossil fuels investment and starting to phase-out from fossil fuels towards RE investments. Fossil fuel subsidy are also in-creasingly under pressure and challenged worldwide by stakeholders. This contributes to the cost for credits and funding for new fossil fuel projects skyrocketing(Banking on Climate Chaos 2022).

Tanzania does not profit from gas & oil

Current and planned fossil extraction and exploration pro-jects in Tanzania, East Africa and Africa in general are de-signed to benefit investors and countries outside Africa. 66 % of the planned new fossil extraction and exploration pro-jects and therefore expected profits are owned non-African international cooperation.(The Skys Limit Africa Report 2021) Most fossil extraction projects are owned by inter-national companies as ExxonMobil,Shell, Ophir Energy and Pavilion Energy ( Fircroft 2020, Ecomonist 2020).

Current and planned pipeline and port infrastructure as the East African Crude Oil Pipeline (EACOP) or the planned LNG terminal in Tanzania have been designed to supply oversea markets rather than addressing energy poverty in Tanza-nia.(Rystad Energy UCube 2021) Additional Tanzania lacks existing gas infrastructure preventing local use and the local context (e.g. existing towns aren’t properly planned etc) isn’t favourable making it costly.

More new Jobs in RE than for Fossil Fuels

Further more, only few high-paying and permanent jobs are located in the fossil fuel extraction sector that are hold mostly by foreign specialists meanwhile RE create 2 to 5 times more jobs. In specific in countries just entering the fossil extraction industry as Mozambique and Tanzania few jobs are held by local population(The Skys Limit Africa Re-port 2021).

Exit fossil fuel production by 2042

Milestones: Reduce by 69 % by 2035

To limit global warming with a high probability of 1.5 ° ex-ploration of fossil fuels have to phase out fast including in developing countries. According to the Tyndall Centre, Tan-zania must phase out fossil fuel production, reducing it by 28 % until 2030, by 69 % until 2035 and by 93 % until 2040 reaching net zero by 2042 to contribute to limiting global warming to 1.5 ° with a probability of 50 %. A just phase-out of fossil fuels exploration must be strategized and mainstreamed in Tanzania’s Energy policies.

Conclusion

New RE are cheap and save—Fossil Fuels are more costly and risky

In sum all this cost-drivers of fossil fuels show that the cost of building and running new fossil-based power plants is increasing while cost of RE are keep falling. Benefits and profits of fossil fuels are more likely to be allocated at inter-national companies and don’t reach local communities. In contrast to this RE create locally more jobs . RE can unlock the access to save clean energies even with low local infrastructure due to saleable off-grid solution. For fossil gas Tan-zania lack of infrastructure to supply rural areas and volatile fuel prices create risk and energy dependencies . Risk and cost of new fossil fuels threaten pathways of sustainable development in Tanzania while new RE can create save and affordable access to energy. By creating access to save and affordable energy new RE can unlock sustainable develop-ment.